District Applies for Mineral License that Encompasses the Majority of the Polymetallic Viken Deposit in Central Sweden

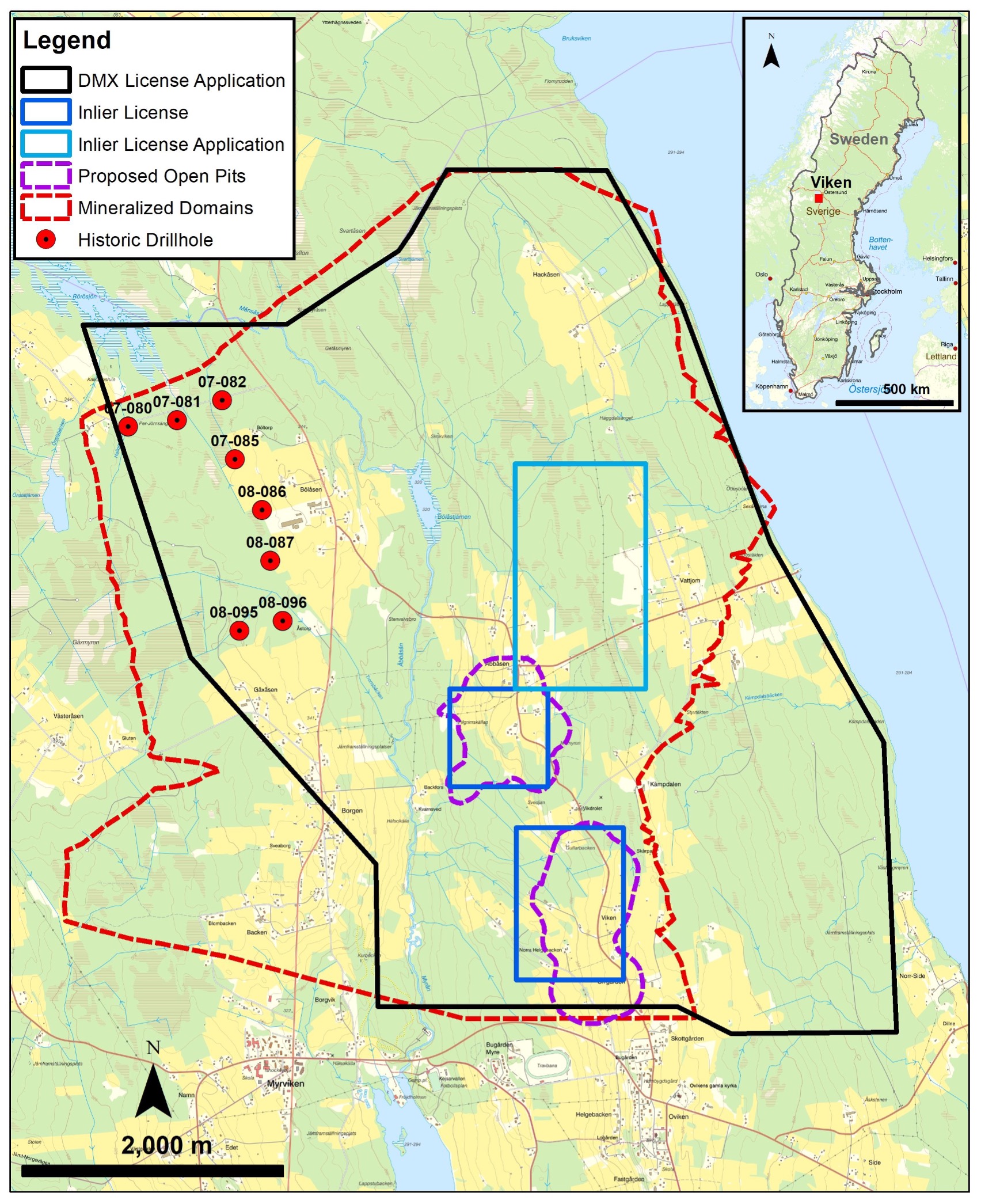

January 5, 2023 – District Metals Corp. (TSX-V: DMX) (FRA: DFPP); (“District” or the “Company”) is pleased to report that Bergslagen Metals AB (a 100% owned Swedish subsidiary of District) has applied for a 2,302 hectare mineral license (Figure 1) to explore for vanadium, nickel, molybdenum, zinc, and other elements, covering approximately 68% of the polymetallic Viken Deposit located in Jämtland County, central Sweden. The Viken Deposit is the largest undeveloped Alum Shale vanadium-uranium-molybdenum-nickel-copper-zinc deposit in Sweden, and amongst the largest deposits by total historic mineral resources of vanadium and uranium in the world. The Bergsstaten (Mining Inspectorate) is expected to reach a decision on the Company’s Viken nr 101 mineral license application by the end of February 2023.

Highlights:

- Mineral license application covers 68% of the Viken Deposit, which is a large polymetallic deposit containing economically significant levels vanadium (V), uranium (U), molybdenum (Mo), nickel (Ni), copper (Cu), and zinc (Zn).

- A 2010 Preliminary Economic Assessment (PEA) Technical Report1 on the Viken Deposit calculated historical mineral resource estimates for V2O5, U3O8, Mo, and Ni of:

- Indicated Mineral Resources: 23.6 million tonnes at an average grade of 0.31% V2O5, 0.019% U3O8, 0.028% Mo, and 0.032% Ni containing 162.8 million lbs of V2O5, 9.9 million lbs of U3O8, 14.7 million lbs of Mo, and 16.5 million lbs of Ni.

- Inferred Mineral Resources: 2.8 billion tonnes at an average grade of 0.27% V2O5, 0.017% U3O8, 0.024% Mo, and 0.032% Ni containing 16.7 billion lbs of V2O5, 1.0 billion lbs of U3O8, 1.5 billion lbs of Mo, and 2.0 billion lbs of Ni.

- A 2014 Updated Resource Estimate and PEA Technical Report2 on the Viken Deposit calculated historical mineral resource estimates for U3O8, Ni, Cu, and Zn of:

- Indicated Mineral Resources: 43.0 million tonnes at an average grade 0.019% U3O8, 0.034% Ni, 0.010% Cu, and 0.041% Zn containing 18.0 million lbs of U3O8, 32.0 million lbs of Ni, 10.0 million lbs Cu, and 38.0 million lbs Zn.

- Inferred Mineral Resources: 3.0 billion tonnes at an average grade 0.017% U3O8, 0.034% Ni, 0.012% Cu, and 0.042% Zn containing 1.15 billion lbs of U3O8, 2.23 billion lbs of Ni, 799.0 million lbs Cu, and 2.8 billion lbs Zn.

This above mineral resource estimates are considered to be “historical estimates” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource, and the Company is not treating these historical estimates as current Mineral Resources. Further details on these historical estimates can be found as footnotes in Tables 1 and 2.

- Sweden’s new government has indicated strong support for nuclear power: A new center-right coalition government formed in October 2022 which included a shift towards supporting and expanding nuclear power in Sweden. There are currently six operating nuclear reactors in Sweden that supply about 40% of the country’s electricity, and the new government has called for the possible restart of Ringhals units 1 and 2, as well as to prepare for the construction of new reactors.

- Motion to remove the moratorium on uranium mining in Sweden: The moratorium on mining uranium came into effect on August 1, 2018. The new center-right coalition government in Sweden passed a motion on November 22, 2022 to revert the Minerals Act back to its original wording before August 1, 2018, such that uranium mining would be possible again in Sweden.

Garrett Ainsworth, CEO of District, commented: “Our mineral license application over much of the polymetallic Viken Deposit presents an excellent opportunity for the Company to obtain a mineral asset that has seen ample recent exploration and development expenditures, which has resulted in the definition of large historic polymetallic resource estimates and positive economic studies.”

The Polymetallic Viken Deposit

The Viken Deposit is situated in the province of Jämtland, approximately 570 km northwest of Stockholm, Sweden. Infrastructure is well developed in the area with daily air service, as well as rail and truck freight services. Electrical power and modern communications are also readily available in the area.

The Geological Survey of Sweden (SGU) carried out work on the Alum Shales from 1977 to 1978 and drilled approximately 19 holes within and in the vicinity of the Viken Deposit. In 2005, Continental Precious Minerals Inc. (CPM) purchased mineral licenses that covered prospective Alum Shales where CPM drilled 26,293 m in 133 holes from 2006 to 2008 to delineate the Viken Deposit.

CPM retained P&E Mining Consultants Inc. to carry out a Resource Estimate and PEA in 2010 that resulted in the following historical estimate:

Table 1: 2010 Viken Deposit Historical Mineral Resource Estimate1

| V2O5 | U3O8 | Mo | Ni | ||

| Indicated Resources | tonnes in 000's | 23,610 | 23,610 | 23,610 | 23,610 |

| lbs/ton | 6.25 | 0.38 | 0.56 | 0.63 | |

| Grade (%) | 0.313 | 0.019 | 0.028 | 0.032 | |

| lbs metal/oxide in 000's | 162,751 | 9,944 | 14,678 | 16,500 | |

| V2O5 | U3O8 | Mo | Ni | ||

| Inferred Resources | tonnes in 000's | 2,830,757 | 2,830,757 | 2,830,757 | 2,830,757 |

| lbs/ton | 5.36 | 0.33 | 0.49 | 0.65 | |

| Grade (%) | 0.268 | 0.017 | 0.024 | 0.032 | |

| lbs metal/oxide in 000's | 16,716,126 | 1,037,661 | 1,516,487 | 2,015,742 |

Notes:

- The mineral resource estimates contained in this table are considered to be “historical estimates” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource, and the Company is not treating these historical estimates as current Mineral Resources. The Company would need to conduct an exploration program, including twinning of historical drill holes in order to verify the Viken Deposit historical estimate as a current mineral resource.

- Weighting of composite samples by linear Ordinary Kriging was used for the estimation of block grades. Kriging parameters were based on the grade-element variography derived from the mineralized shale domain. A block discretization level of 5 x 5 x 2 was used during kriging. The mineralized shale domain was treated as a hard boundary, and data used during estimation were limited to composite samples located within the mineralized shale domain wireframe. Only blocks wholly or partially within the mineralized shale domain were estimated. The mineralized shale domain was treated as a hard boundary, and data used during estimation.

- During the first pass, four samples from each of three drill holes within 110m of the block centroid were required. All block grades estimated during the first pass were classified as Indicated.

- During the second pass, blocks not populated during the first pass were estimated. A minimum of three and a maximum of six samples from one or more drillholes within 330 m of the block centroid were required. All block grades estimated during the second pass were classified as Inferred.

- An internal break-even cut-off grade of US $7.50/tonne was used in reporting this historical estimate.

In 2012, a bio-heap leach scenario was evaluated, and P&E Mining Consultants were retained again to conduct an Updated Technical Report, Resource Estimate and Preliminary Economic Assessment on the Viken Deposit with the following historical estimate:

Table 2: 2014 Viken Deposit Historical Mineral Resource Estimate2

| U3O8 | Ni | Cu | Zn | ||

| Indicated Resources | tonnes in 000's | 43 | 43 | 43 | 43 |

| lbs/ton | 0.38 | 0.68 | 0.21 | 0.81 | |

| Grade (%) | 0.019 | 0.034 | 0.010 | 0.041 | |

| lbs metal/oxide in 000's | 18 | 32 | 10 | 38 | |

| U3O8 | Ni | Cu | Zn | ||

| Inferred Resources | tonnes in 000's | 3,019 | 3,019 | 3,019 | 3,019 |

| lbs/ton | 0.35 | 0.67 | 0.24 | 0.84 | |

| Grade (%) | 0.017 | 0.034 | 0.012 | 0.042 | |

| lbs metal/oxide in 000's | 1,145 | 2,230 | 799 | 2,802 |

Notes:

- The mineral resource estimates contained in this table are considered to be “historical estimates” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource, and the Company is not treating these historical estimates as current Mineral Resources. The Company would need to conduct an exploration program, including twinning of historical drill holes in order to verify the Viken Deposit historical estimate as a current mineral resource.

- Block grades were estimated using Ordinary Kriging of capped composite samples. Only blocks wholly or partially within the mineralized shale domain were estimated, and between six and fifteen samples from two or more drill holes within 660 m of the block centroid were used for estimation. A small area in the Southern portion of the deposit with an average drillhole spacing of approximately 120 m has been classified as Indicated.

- An internal break-even cut-off grade of US $11.00/tonne was used in reporting this historical estimate.

The Viken Deposit is a polymetallic shale resource contained within the Cambrian Viken Shale which regionally is referred to as the Alum Shale. The Alum Shale is enriched in metals such as vanadium, uranium, nickel, copper, zinc, and molybdenum. It occurs over a significant area in Sweden and is locally valued as a bituminous shale with recoverable hydrocarbons. The Alum Shale is regionally extensive in Sweden.

The stratigraphy across the Viken Mineral License application consists of upper Middle and Upper Cambrian age Alum Shale occurring as both in situ and fault detached blocks, with the latter having greater potential for economic mineralization due to imbrication of mineralized blocks. The Alum Shale is mostly exposed at surface and is underlain by Proterozoic granites and gneisses thrust Eastward over Archean granitic basement rocks. The thickness of the Alum Shale host rock has been tectonically thickened from 20 to 30 m by thrusting and folding during the Silurian to approximately 180 m.

Mineralization of potential economic significance is hosted in Middle and Upper Cambrian Alum Shale, with the Upper Cambrian age strata more enriched in vanadium and uranium than the Middle Cambrian3. Vanadium occurs within the lattice of a mica mineral named roscoelite. Uranium values are predominantly associated with sub-micron-scale uraninite crystals. Nickel, molybdenum, copper and zinc are present as sulphides.

Figure 1: Plan View of Viken Mineral License and Outline of Viken Deposit

References

1 Preliminary Economic Assessment on the Viken MMS Project, Sweden for Continental Precious Minerals Inc. 2010. P&E Mining Consultants Inc., EHA Engineering Ltd., and G.A. Harron & Associates Inc..

2 Updated Technical Report, Resource Estimate and Preliminary Economic Assessment on the Viken MMS Project, Sweden for Continental Precious Minerals Inc. 2014. P&E Mining Consultants Inc..

3 Andersson, A, Dahlman, B., Gee, D.G. and Snäll, S., 1985: The Scandanavian Alum Shale, S.G.U., Ser. Ca Nr 56, 50 p.

Technical Information

All scientific and technical information in this news release has been prepared by, or approved by Garrett Ainsworth, PGeo, President and CEO of the Company. Mr. Ainsworth is a qualified person for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

The data disclosed in this news release is related to mineral resource estimates that are considered to be “historical estimates” under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). A Qualified Person has not done sufficient work to classify the historical estimate as a current mineral resource, and the Company is not treating these historical estimates as current Mineral Resources. The Company would need to conduct an exploration program, including twinning of historical drill holes in order to verify the Viken Deposit historical estimate as a current mineral resource.

Mr. Ainsworth has not verified any of the information regarding any of the properties or projects referred to herein other than the Viken Mineral License application. Mineralization on any other properties referred to herein is not necessarily indicative of mineralization on the Viken Mineral License application.

About District Metals Corp.

District Metals Corp. is led by industry professionals with a track record of success in the mining industry. The Company’s mandate is to seek out, explore, and develop prospective mineral properties through a disciplined science-based approach to create shareholder value and benefit other stakeholders.

The advanced exploration stage Tomtebo Property is located in the Bergslagen Mining District of south-central Sweden is the Company’s main focus. Tomtebo comprises 5,144 ha and is situated between the historic Falun Mine and Boliden’s Garpenberg Mine that are located 25 km to the northwest and southeast, respectively. Two historic polymetallic mines and numerous polymetallic showings are located on the Tomtebo Property along an approximate 17 km trend that exhibits similar geology, structure, alteration and VMS/SedEx style mineralization as other significant mines within the district. Mineralization that is open at depth and along strike at the historic mines on the Tomtebo Property has not been followed up on, and modern systematic exploration has never been conducted on the Property.

For further information on the Tomtebo Property, please see the technical report entitled “NI 43-101 Update Technical Report on the Tomtebo Project, Bergslagen Region of Sweden” dated effective October 15, 2020 and amended and restated on February 26, 2021, which is available on SEDAR at www.sedar.com.

On Behalf of the Board of Directors

“Garrett Ainsworth”

President and Chief Executive Officer

(604) 288-4430

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information.

This news release contains certain statements that may be considered “forward-looking information” with respect to the Company within the meaning of applicable securities laws. In some cases, but not necessarily in all cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved” and any similar expressions. In addition, any statements that refer to expectations, predictions, indications, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events. Forward-looking statements in this news release relating to the Company include, among other things, statements relating to the Company’s application for a 2,302 hectare mineral license (Figure 1) to explore for vanadium, nickel, molybdenum, zinc, and other elements covering a portion of the polymetallic Viken Deposit located in Jämtland County, central Sweden; the expected timing of the Bergsstaten’s (Mining Inspectorate) decision on the Company’s Viken nr 101 mineral license application; the Company’s planned exploration activities, including its drill target strategy and next steps for the Viken Property; and the Company’s interpretations and expectations about the results on the Viken Property.

These statements and other forward-looking information are based on opinions, assumptions and estimates made by the Company in light of its experience and perception of historical trends, current conditions and expected future developments, as well as other factors that the Company believes are appropriate and reasonable in the circumstances, as of the date of this news release, including, without limitation, assumptions about the reliability of historical data and the accuracy of publicly reported information regarding past and historic mines in the Bergslagen district; the Company’s ability to raise sufficient capital to fund planned exploration activities, maintain corporate capacity; and stability in financial and capital markets

Forward-looking information is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by the Company as of the date such statements are made, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to risks associated with the following: the likelihood of the Bergsstaten’s (Mining Inspectorate) decision to approve the Company’s Viken nr 101 mineral license application; the reliability of historic data regarding the Viken Deposit and the Tomtebo Property; the Company’s ability to raise sufficient capital to finance planned exploration (including incurring prescribed exploration expenditures required by the Tomtebo Purchase Agreement, failing which the Tomtebo Property will be forfeited without any repayment of the purchase price); the Company’s limited operating history; the Company’s negative operating cash flow and dependence on third-party financing; the uncertainty of additional funding; the uncertainties associated with early stage exploration activities including general economic, market and business conditions, the regulatory process, failure to obtain necessary permits and approvals, technical issues, potential delays, unexpected events and management’s capacity to execute and implement its future plans; the Company’s ability to identify any mineral resources and mineral reserves; the substantial expenditures required to establish mineral reserves through drilling and the estimation of mineral reserves or mineral resources; the Company’s dependence on one material project, the Tomtebo Property; the uncertainty of estimates used to calculated mineralization figures; changes in governmental regulations; compliance with applicable laws and regulations; competition for future resource acquisitions and skilled industry personnel; reliance on key personnel; title matters; conflicts of interest; environmental laws and regulations and associated risks, including climate change legislation; land reclamation requirements; changes in government policies; volatility of the Company’s share price; the unlikelihood that shareholders will receive dividends from the Company; potential future acquisitions and joint ventures; infrastructure risks; fluctuations in demand for, and prices of gold, silver and copper; fluctuations in foreign currency exchange rates; legal proceedings and the enforceability of judgments; going concern risk; risks related to the Company’s information technology systems and cyber-security risks; and risk related to the outbreak of epidemics or pandemics or other health crises, including the recent outbreak of COVID-19. For additional information regarding these risks, please see the Company’s Annual Information Form, under the heading “Risk Factors”, which is available at www.sedar.com. These factors and assumptions are not intended to represent a complete list of the factors and assumptions that could affect the Company. These factors and assumptions, however, should be considered carefully. Although the Company has attempted to identify factors that would cause actual actions, events or results to differ materially from those disclosed in the forward-looking statements or information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Also, many of such factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward-looking statements or information. The forward-looking information is made as of the date of this news release, and the Company assumes no obligation to publicly update or revise such forward-looking information, except as required by applicable securities laws.

All scientific and technical information contained in this news release has been prepared by or reviewed and approved by Garrett Ainsworth, PGeo, President and CEO of the Company. Mr. Ainsworth is a qualified person for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.