District Commences Phase II Drill Program at the Tomtebo Property

October 7, 2021 – District Metals Corp. (TSX-V: DMX) (FRA: DFPP); ("District" or the “Company”) is pleased to announce that it has commenced core drilling a minimum of 5,000 m with two rigs at its high grade polymetallic Tomtebo Property located in the Bergslagen Mining District in south-central Sweden. Hy-Tech Drilling Sweden AB has been awarded the contract for this Phase II drill program.

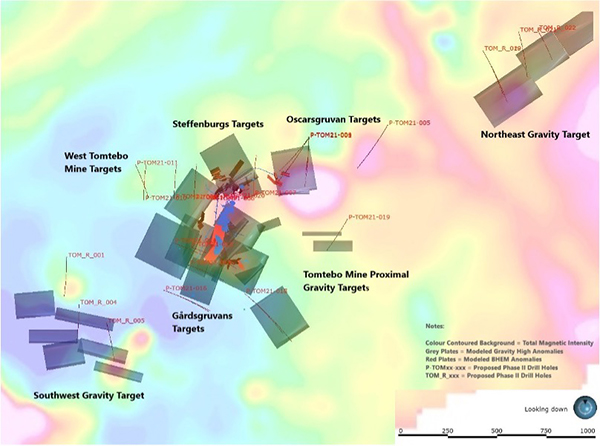

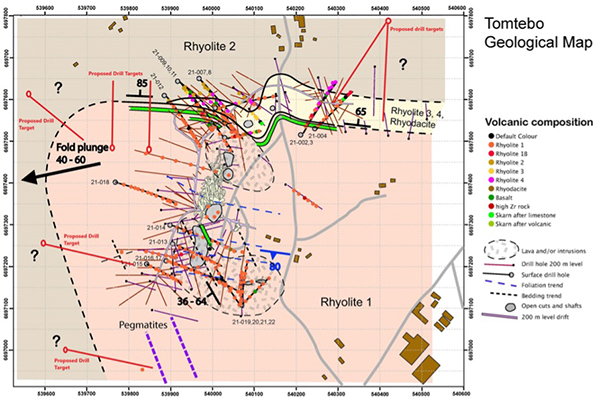

The main objectives of the Phase II drill program include: 1) aggressive step outs from significant mineralization encountered during our Phase I drill program at the historic Tomtebo Mine; 2) testing a new and comprehensive interpretation proximal to the large mineralized system at the Tomtebo Mine through the use of whole rock geochemistry, Borehole Electromagnetic (BHEM) anomalies, and coincident geophysical anomalies; 3) testing virgin regional targets that comprise coincident gravity, magnetic, and conductive anomalies located up to 1 km northeast and 600 m southwest along trend from the Tomtebo Mine. The proposed Phase II drill hole locations are shown in Figures 1 and 2.

Garrett Ainsworth, CEO of District, commented: “Since acquiring the Tomtebo Property in June 2020 we have been diligently acquiring and compiling exploration data to better understand the polymetallic mineral system at Tomtebo, which has prioritized the best targets with potential to discover economic mineralization. We now have a much better understanding of Tomtebo thanks to our technical team’s breadth of modern knowledge on polymetallic deposits in the Bergslagen, and through innovative exploration techniques such as whole rock geochemistry and geophysical surveys that were never previously carried out at Tomtebo. Every exploration program we have conducted at Tomtebo has delivered positive overlapping anomalies and data that makes this Phase II drill program the most exciting to date.”

A minimum of 5,000 m of core drilling in approximately 14 holes is planned at the historic Tomtebo Mine and up to 1 km along the Tomtebo Mine trend with a focus on the following targets:

- Steffenburgs zone: step outs below hole TOM21-001, which intersected 8.2 m at 20.94% ZnEq1 (65.3 to 73.5 m) and is supported by the largest and strongest BHEM conductive plate from the Phase I drill program.

- Oscarsgruvan zone: step outs below and east-northeast from hole TOM21-002, which intersected 12.55 m at 331.9 g/t AgEq2 (90.8 to 103.35 m), and 4.8 m at 505.6 g/t AgEq2 (125.0 to 129.80 m) supported by numerous geophysical anomalies and the whole rock geochemical interpretation.

- Gårdsgruvans zone: step outs below and southwest from hole TOM21-017, which intersected 13.4 m at 0.68% CuEq3 (88.1 to 101.5 m), 16.2 m at 0.87% CuEq3 (206.8 to 223.0 m), 5.6 m at 7.11% ZnEq1 (269.2 to 274.8 m), 5.05 m at 2.86% CuEq3 (278.1 to 283.15 m), and 2.0 m at 2.18% CuEq3 (295.3 to 297.3 m) supported by numerous geophysical anomalies and the whole rock geochemical interpretation.

- Northeast Gravity Target: testing a very significant blind gravity high anomaly with coincident magnetic and conductive anomalies located 1 km northeast along trend from the historic Tomtebo Mine. This gravity high anomaly remains open to the northeast and at depth where an exploration target of 34.0 Mt at a density of 3.45 g/cm3 has been modeled at shallow depths (40 to 320 m).

- Southwest Gravity Target: testing a significant gravity high anomaly with coincident magnetic and conductive anomalies located 600 m southwest along trend from the historic Tomtebo Mine. This gravity high anomaly is associated with historic iron sulphide occurrences, which are known to sometimes coalesce with polymetallic sulphide mineralization in the Bergslagen District. An exploration target of 28.7 Mt at a density of 3.50 g/cm3 has been modeled at shallow depths (near surface to 420 m) at this target.

- Tomtebo Mine Proximal Gravity Targets: testing gravity high anomalies to the south and east of the historic Tomtebo Mine, which are supported by coincident magnetic and conductive anomalies.

- West of Tomtebo Mine: systematic analysis of whole rock geochemistry in drill core from the Phase I program combined with structural mapping data has resulted in an interpretive breakthrough where the massive sulphide fertile horizon (between the Rhyolite 1 and 2) has been identified. This fertile horizon remains wide open and untested for at least 800 m west of hole TOM21-012 and the historical Tomtebo Mine.

The potential quantity and density of the gravity exploration targets described above are conceptual in nature, and it is not possible to make assumptions on metal grades from a gravity survey. There has been insufficient or no drilling to define a mineral resource or to determine if polymetallic sulphide mineralization is present, respectively. It is uncertain if further drilling will result in these gravity exploration targets being delineated as a mineral resource or resulting in the discovery of polymetallic sulphide mineralization.

The Company has also granted a total of 2,220,000 stock options to directors, officers, employees and consultants of the Company, in accordance with the provisions of its stock option plan. Each stock option is exercisable at $0.25 per common share (being above the closing price of the Company’s common shares on October 6, 2021, the grant date). All stock options have a term of five years and vest on the grant date.

Figure 1: Plan View of Proposed Phase II Drill Holes

Figure 2: Massive Sulphide Fertile Horizon Between Rhyolite 1 and 2

References

1 Metal prices used in USD for the ZnEq calculation were based on Ag $15.00/oz, Au $1650/oz, Cu $2.15/lb, Zn $0.85/lb, and Pb $0.75/lb. ZnEq equals = Zn% + (Ag g/t × 0.0257) + (Au g/t x 2.831) + (Cu% × 2.529) + (Pb% × 0.882). The use of ZnEq is to calculate cut-off grades for exploration purposes, and no adjustments were made for metal recovery.

2 Metal prices used in USD for the AgEq calculation were based on Ag $15.00/oz, Au $1650/oz, Cu $2.15/lb, Zn $0.85/lb, and Pb $0.75/lb. AgEq equals = Ag g/t + (Au g/t × 110) + (Cu% × 98.286) + (Zn% × 38.857) + (Pb% × 34.286). The use of AgEq is to calculate cut-off grades for exploration purposes, and no adjustments were made for metal recovery.

3 Metal prices used in USD for the CuEq calculation were based on Ag $15.00/oz, Au $1650/oz, Cu $2.15/lb, Zn $0.85/lb, and Pb $0.75/lb. CuEq equals = Cu% + (Au g/t x 1.1192) + (Ag g/t × 0.0102) + (Zn % x 0.3953) + (Pb % x 0.3488). The use of CuEq is to calculate cut-off grades for exploration purposes, and no adjustments were made for metal recovery.

Technical Information

All scientific and technical information in this news release has been prepared by, or approved by Garrett Ainsworth, PGeo, President and CEO of the Company. Mr. Ainsworth is a qualified person for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

The drill core reported in this news release was logged and prepared at the District Metals AB core facility in Säter, Sweden before submittal to ALS Geochemistry in Malå, Sweden where the drill core is cut, bagged, and prepared for analysis. Sample pulps were sent to ALS Geochemistry in Ireland (an accredited mineral analysis laboratory) for analysis. Samples were analyzed using a multi-element ultra trace method combining a four-acid digestion with ICP-MS analytical package (“ME-MS61”). Over limit sample values were re-assayed for: (1) values of copper >1%; (2) values of zinc >1%; (3) values of lead >1%; and (4) values of silver >100 g/t using the high-grade material ICP-AES analytical package (“ME-OG62”). Additional over limit sample values were re-assayed for: (1) values of zinc >30%; (2) values of lead >20% using the high precision analysis of base metal ores AAS analytical package (“Zn, Pb-AAORE”). Gold, platinum, and palladium were analyzed using the 30 g lead fire assay with ICP-AES finish analytical package (“PGM-ICP23”). Certified standards, blanks, and duplicates were inserted into the sample shipment to ensure integrity of the assay process. Selected samples were chosen for duplicate assay from the coarse reject and pulps of the original sample. No QA/QC issues were noted with the results reported.

Some of the data disclosed in this news release is related to historical drilling results. District has not undertaken any independent investigation of the sampling nor has it independently analyzed the results of the historical exploration work in order to verify the results. District considers these historical drill results relevant as the Company is using this data as a guide to plan exploration programs. The Company's current and future exploration work includes verification of the historical data through drilling.

Mr. Ainsworth has not verified any of the information regarding any of the properties or projects referred to herein other than the Tomtebo Property. Mineralization on any other properties referred to herein is not necessarily indicative of mineralization on the Tomtebo Property.

About District Metals Corp.

District Metals Corp. is led by industry professionals with a track record of success in the mining industry. The Company’s mandate is to seek out, explore, and develop prospective mineral properties through a disciplined science-based approach to create shareholder value and benefit other stakeholders.

The advanced exploration stage Tomtebo Property is located in the Bergslagen Mining District of south-central Sweden is the Company’s main focus. Tomtebo comprises 5,144 ha and is situated between the historic Falun Mine and Boliden’s Garpenberg Mine that are located 25 km to the northwest and southeast, respectively. Two historic polymetallic mines and numerous polymetallic showings are located on the Tomtebo Property along an approximate 17 km trend that exhibits similar geology, structure, alteration and VMS/SedEx style mineralization as other significant mines within the district. Mineralization that is open at depth and along strike at the historic mines on the Tomtebo Property has not been followed up on, and modern systematic exploration has never been conducted on the Property.

For further information on the Tomtebo Property, please see the technical report entitled “NI 43-101 Update Technical Report on the Tomtebo Project, Bergslagen Region of Sweden” dated effective October 15, 2020 and amended and restated on February 26, 2021, which is available on SEDAR at www.sedar.com.

On Behalf of the Board of Directors

“Garrett Ainsworth”

President and Chief Executive Officer

(604) 288-4430

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information.

This news release contains certain statements that may be considered “forward-looking information” with respect to the Company within the meaning of applicable securities laws. In some cases, but not necessarily in all cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects” or “does not expect”, “is expected”, “an opportunity exists”, “is positioned”, “estimates”, “intends”, “assumes”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved” and any similar expressions. In addition, any statements that refer to expectations, predictions, indications, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events. Forward-looking statements in this news release relating to the Company include, among other things, statements relating to the Company’s planned exploration activities, including its drill target strategy and next steps for the Tomtebo Property; the company’s interpretations and expectations about the mineralization of the Tomtebo Mine; the Company’s belief that the numerous gravity high anomalies identified at the historic Tomtebo Mine provide immense expansion potential; the Company’s belief that the modeled gravity high anomalies at the historic Tomtebo Mine could correspond with polymetallic and/or iron sulphide mineralization, or a mafic unit; and the Company’s belief that the gravity high anomaly located one kilometer to the northeast of the Tomtebo Mine represents a potential grassroots discovery opportunity with a modeled tonnage that compares with the historic production tonnage from the historic Falun Mine.

These statements and other forward-looking information are based on opinions, assumptions and estimates made by the Company in light of its experience and perception of historical trends, current conditions and expected future developments, as well as other factors that the Company believes are appropriate and reasonable in the circumstances, as of the date of this news release, including, without limitation, assumptions about the reliability of historical data and the accuracy of publicly reported information regarding past and historic mines in the Bergslagen district; the Company’s ability to raise sufficient capital to fund planned exploration activities, maintain corporate capacity and satisfy the exploration expenditure requirements required by the definitive purchase agreement between the Company and the vendor of the Tomtebo Property (the "Tomtebo Purchase Agreement") by the times specified therein; and stability in financial and capital markets.

Forward-looking information is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by the Company as of the date such statements are made, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information, including but not limited to risks associated with the following: the reliability of historic data regarding the Tomtebo Property; the Company’s ability to raise sufficient capital to finance planned exploration (including incurring prescribed exploration expenditures required by the Tomtebo Purchase Agreement, failing which the Tomtebo Property will be forfeited without any repayment of the purchase price); the Company’s limited operating history; the Company’s negative operating cash flow and dependence on third-party financing; the uncertainty of additional funding; the uncertainties associated with early stage exploration activities including general economic, market and business conditions, the regulatory process, failure to obtain necessary permits and approvals, technical issues, potential delays, unexpected events and management’s capacity to execute and implement its future plans; the Company’s ability to identify any mineral resources and mineral reserves; the substantial expenditures required to establish mineral reserves through drilling and the estimation of mineral reserves or mineral resources; the Company’s dependence on one material project, the Tomtebo Property; the uncertainty of estimates used to calculated mineralization figures; changes in governmental regulations; compliance with applicable laws and regulations; competition for future resource acquisitions and skilled industry personnel; reliance on key personnel; title matters; conflicts of interest; environmental laws and regulations and associated risks, including climate change legislation; land reclamation requirements; changes in government policies; volatility of the Company’s share price; the unlikelihood that shareholders will receive dividends from the Company; potential future acquisitions and joint ventures; infrastructure risks; fluctuations in demand for, and prices of gold, silver and copper; fluctuations in foreign currency exchange rates; legal proceedings and the enforceability of judgments; going concern risk; risks related to the Company’s information technology systems and cyber-security risks; and risk related to the outbreak of epidemics or pandemics or other health crises, including the recent outbreak of COVID-19. For additional information regarding these risks, please see the Company’s Annual Information Form, under the heading “Risk Factors”, which is available at www.sedar.com. These factors and assumptions are not intended to represent a complete list of the factors and assumptions that could affect the Company. These factors and assumptions, however, should be considered carefully. Although the Company has attempted to identify factors that would cause actual actions, events or results to differ materially from those disclosed in the forward-looking statements or information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Also, many of such factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward-looking statements or information. The forward-looking information is made as of the date of this news release, and the Company assumes no obligation to publicly update or revise such forward-looking information, except as required by applicable securities laws. All scientific and technical information contained in this news release has been prepared by or reviewed and approved by Garrett Ainsworth, PGeo, President and CEO of the Company. Mr. Ainsworth is a qualified person for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.